A study published in Nature, in June of this year, found that 46 percent of the Vietnamese population lived in areas prone to flooding. This ranked the Southeast Asian nation’s population the third most exposed out of 188 countries included in the study.

It’s no surprise then that global warming is a big issue for this relatively low-lying nation. It is, however, also an emerging economy and one of the fastest growing in the world.

This creates somewhat of a conundrum for Vietnam with climate change mitigation and economic development oftentimes running at odds with each other.

Indeed, Vietnam’s manufacturing base is expanding rapidly and its thirst for cheap energy seems almost unquenchable. As a result, quick, low tech, and relatively low-cost fossil fuels have become a cornerstone of Vietnam’s economic development.

This will, however, have to change over the next thirty-years if Vietnam is to reach its net zero commitment.

Vietnam’s carbon emissions reduction legal framework

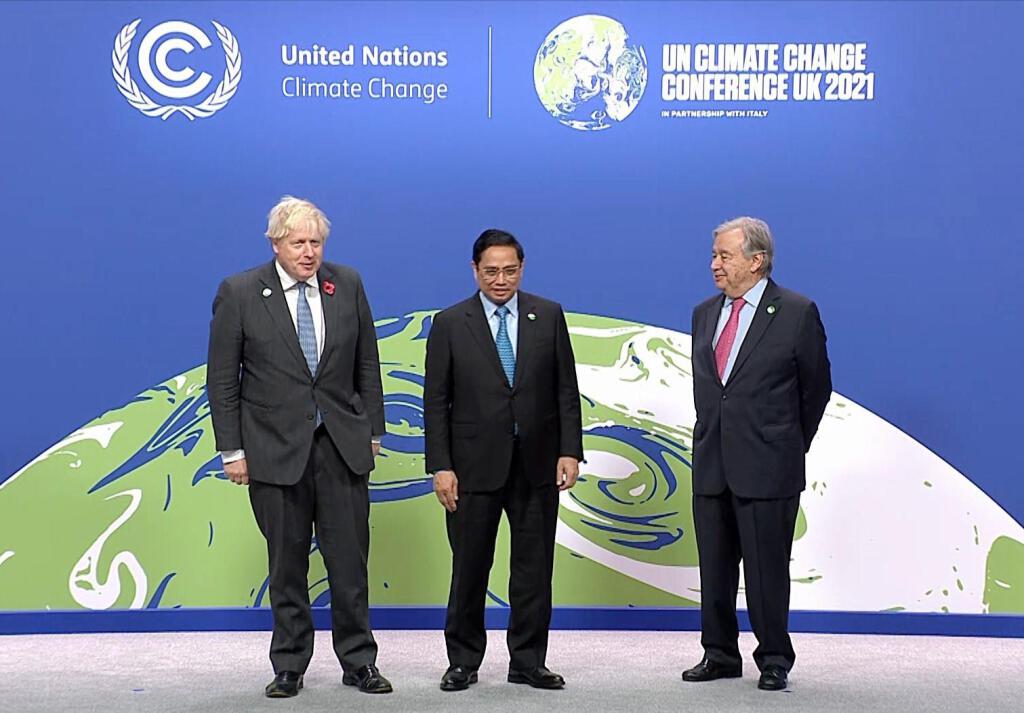

In the year between COP26 and COP27 Vietnam has taken a number of steps on the road to meeting its net zero commitment. It has set targets, started work on a carbon market, and has issued clear guidelines for energy market development planning.

Greenhouse gas (GHG) emissions reduction targets

Decree 06 forms the backbone of Vietnam’s carbon emissions reductions commitment. Passed in January of this year, it outlines key reduction targets for each ministry and the fields in which these ministries are responsible for reducing GHG emissions.

| Ministry | Field | CO2 million tons |

| Ministry of Industry and Trade | Energy production Energy consumption in industry | 268.5 |

| The Ministry of Transportation | Energy consumption in transportation | 37.5 |

| Ministry of Agriculture and Rural Development | Energy consumption in agriculture Agricultural production Forestry | 129.8 |

| Ministry of Construction | Industrial processes Energy consumption in cement production Building | 74.3 |

| Ministry of Natural Resources and Environment | Waste treatment | 53.7 |

| Total by 2030 | 563.8 |

The prime minister also issued a decision back in January, an appurtenance to Decree 06, that lists 21 sectors and just shy of 2,000 enterprises required to complete a GHG inventory.

Not only will this list help to isolate key emitters and monitor progress, but it will also form part of the foundations of a planned emissions trading scheme in Vietnam.

Building a domestic carbon market

Carbon markets have become a popular way for countries to meet their carbon emissions reduction targets. Tried and tested around the world, most notably in the European Union, Vietnam is also embracing the concept.

A large section of Decision 06 is dedicated to Vietnam’s carbon trading ambitions.

It outlines the key foundations of the platform and sets a timeline for trial operation by 2025, and full operation by 2028.

This may be a tall order, but without a carbon market Vietnamese goods may be subjected to carbon tariffs in markets where emissions trading schemes are operational, for example, the European Union.

Guidelines on Vietnam’s power development

Vietnam will require extensive development of its energy sector to accommodate its growing economy.

Planning for this inevitable reality has been ongoing for over a year. Specifically, the Power Development Plan 8 (PDP8) has been in the works which, when approved, will outline how Vietnam’s energy sector will be developed between now and 2030.

It is, however, well overdue with ongoing revisions and changes prolonging the process.

The most recent draft made public last year, pre-dates Vietnam’s COP26 commitment. Its next iteration is, therefore, expected to see some big changes in Vietnam’s energy mix.

These revisions, though not as yet official, were outlined in a letter to the Prime Minister from the Ministry of Industry and Trade, back in July. It emphasises a shift away from coal to renewables and gas.

Driver’s of change in Vietnam’s decarbonization

Vietnam’s enthusiasm for reducing carbon emissions goes beyond the threat of climate change to include the economic cost of inaction.

Vietnam is now an intricate part of global supply chains and its economic growth is largely predicated on exporting manufactured goods around the world. Therefore, attitudes among Vietnam’s key trading partners may also be contributing to Vietnam’s need to decarbonize.

Carbon barriers to trade

The Carbon Border Adjustment Mechanism (CBAM) is an initiative that the EU plans to introduce in 2023. Essentially importers of goods from countries whose carbon emissions reduction schemes are lesser than that of the EU, will need to buy carbon permits in line with the EU’s existing emissions trading scheme.

This means that countries producing carbon intensive goods may see exports to the EU become more expensive.

In its early stages the CBAM will only apply to five key, high-polluting sectors. However, among them is cement, which is a key export of Vietnam to the EU. In 2020, Vietnam exported US$34 million worth of cement to the bloc, accounting for about 9 percent of its cement imports.

The EU has also not ruled out expanding the scope of products covered.

Financing carbon reductions through international assistance

Perhaps the most pressing challenge for Vietnam, however, is how to fund its transition to clean energy.

Like most emerging markets, Vietnam is looking for international finance and support.

This has been somewhat fruitful with a handful of developed nations putting a US$5 billion deal on the table earlier this year. This would have been made up of a series of loans and grants.

But Vietnam has so far been reluctant to accept, holding out for something bigger, more in line with the US$8.5 deal reached with South Africa, or the US$10 billion on offer to Indonesia, according to Politico.

It’s also been reported that Vietnam is looking for more in the way of grants rather than loans with an aversion to taking on more debt.

What to watch in year two of Vietnam’s pursuit of net zero

Although Vietnam might not reach an agreement on financial aid at COP27, according to Quartz , “observers say that the Vietnam deal could come through by the end of the year.”

In the meantime, Vietnam will be watching negotiations between other emerging economies and developed country financiers closely. How these deals are developed and what concessions are made could provide valuable insights for Vietnam in reworking its own deal.

Furthermore, the final draft of the PDP8 should be completed in 2023 and approved. What that might look like is still somewhat ambiguous at present but a shift to LNG and greater renewables, over previous drafts of the agreement, should be expected.

Finally, now that targets are in place, monitoring those targets and ensuring they are met will be key to proving Vietnam’s policy effective and its COP26 commitment achievable.

Mark Barnes